Introduction:

The regulatory landscape for businesses is constantly evolving, and small and medium-sized enterprises (SMEs) face increasing challenges in complying with increasingly stringent laws and regulations. Finding solutions to meet these requirements is crucial for preserving your company’s reputation and avoiding costly penalties.

Yoneos CRM, a powerful and comprehensive customer relationship management (CRM) software, can help you navigate this regulatory maze and ensure your operations are compliant.

Key Features of Yoneos CRM:

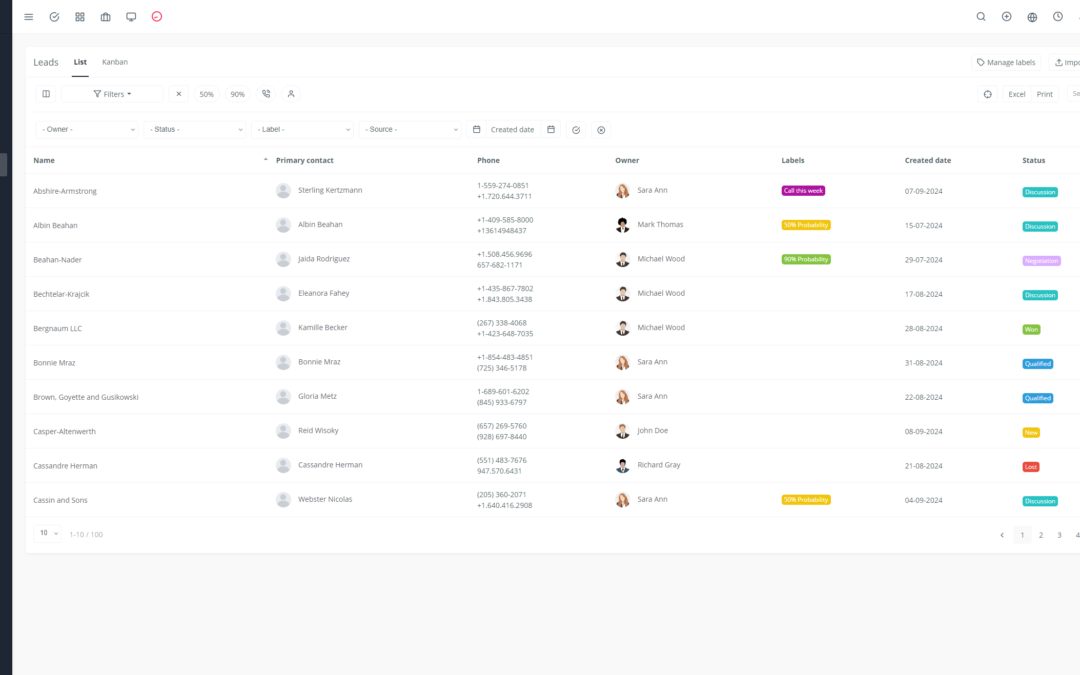

Yoneos CRM is more than just a customer tracking tool. It offers a full range of features that help you manage customer interactions, automate business processes, and ensure regulatory compliance:

Contact and Company Management: Organize and store your customer and partner information securely and in compliance with regulations.

Opportunity and Sales Management: Track your sales, manage your pipelines, and close deals seamlessly.

Ticket and Customer Service Management: Provide excellent customer service while ensuring compliance with data protection regulations.

Task and Workflow Automation: Simplify your business processes and minimize human error, ensuring consistent application of policies and procedures.

Reporting and Analytics: Gain valuable insights into your customer data and operations to make informed and compliant decisions.

How Yoneos CRM Helps SMEs Comply with Regulations:

Yoneos CRM offers key features that help you meet regulatory requirements in various areas:

1. Data Management and Privacy Protection:

Access Control and User Management: Define specific roles and permissions to ensure only authorized employees access sensitive data.

Data Encryption: Protect your customer’s sensitive information with robust encryption technologies.

Secure Data Deletion: Securely delete customer data when it’s no longer needed, in accordance with applicable regulations.

Activity Logging: Keep a record of all actions performed on customer data to ensure transparency and traceability.

2. GDPR and CCPA Compliance:

Consent and Preference Management: Obtain explicit consent from customers for data processing and allow them to manage their privacy preferences.

Data Subject Rights: Enable customers to access, rectify, delete, or restrict the processing of their data, as required by GDPR and CCPA.

Data Breach Reporting: Report data breaches promptly and transparently, in accordance with regulatory requirements.

3. PCI DSS Compliance for Payment Processing:

Payment Data Security: Protect your customer’s credit card information by adhering to PCI DSS security standards.

Secure Access Control: Limit access to sensitive payment data to a limited number of authorized employees.

Regular Auditing and Monitoring: Perform regular audits and analysis to ensure ongoing compliance with PCI DSS standards.

4. HIPAA Compliance for Healthcare Data:

Protection of Protected Health Information (PHI): Store and process healthcare data securely and in compliance with HIPAA requirements.

Access Control and Authorization: Limit access to protected health information to authorized employees.

Security and Privacy Protocols: Implement strict security protocols to protect healthcare data from unauthorized access.

5. Compliance with Anti-Corruption and Anti-Money Laundering Legislation:

Due Diligence Verification: Perform thorough due diligence checks on your customers and partners to avoid illegal activities.

Transaction Monitoring: Monitor financial transactions to detect suspicious activity.

Compliance Reporting: Complete the required compliance reports for relevant authorities.

6. Contract Management and Contractual Obligations:

Contract Management: Electronically store, organize, and manage your contracts with your customers and partners.

Obligation Management: Track contractual obligations, due dates, and required actions to ensure compliance.

Contract Auditing: Perform regular audits to verify compliance with contractual requirements.

7. Risk Management and Auditing:

Risk Assessment: Identify risks associated with regulatory compliance and develop mitigation strategies.

Internal Audits: Conduct regular internal audits to verify compliance with regulatory requirements.

Incident Management: Effectively manage compliance incidents to minimize damage and penalties.

8. Reporting and Activity Traceability:

Compliance Reports: Generate detailed reports on compliance activities to demonstrate your adherence to regulations.

Event Logging: Keep a record of all compliance-related actions and events to ensure traceability.

9. Process and Task Automation:

Compliance Task Automation: Automate repetitive tasks such as data checks and reports to improve efficiency and accuracy.

Compliance Workflows: Create automated workflows to ensure compliance processes are consistently applied.

10. Access Control and User Management:

Roles and Permissions: Define specific roles and permissions for users to limit access to sensitive data to authorized employees.

Two-Factor Authentication: Enhance security by using two-factor authentication to prevent unauthorized access.

Activity Logging: Track all user actions to ensure accountability and auditability.

11. Data Security and Protection Against Cyber Threats:

Data Security Measures: Implement robust security measures to protect customer data from unauthorized access and cyberattacks.

Regular Backups: Ensure regular data backups to guarantee data recovery in the event of loss or corruption.

Threat Monitoring and Analysis: Actively monitor for potential threats and implement incident detection and response systems.

12. Integration with Other Systems and Applications:

Seamless Integration: Integrate Yoneos CRM with other systems and applications such as accounting systems, document management systems, and marketing platforms.

Centralized Data Flows: Bring together data from various systems into a single platform for centralized management and consistent analysis.

13. Industry Compliance and Specific Requirements:

Industry Adaptations: Yoneos CRM can be adapted to meet the specific compliance requirements of your industry, such as healthcare, financial services, or retail.

Customization: Customize Yoneos CRM to meet your company’s specific requirements and applicable regulations.

Costs and Benefits of Using Yoneos CRM for Compliance:

Costs: The cost of using Yoneos CRM will vary depending on your needs and the number of users. However, the benefits in terms of reduced risk, improved efficiency, and compliance can far outweigh the initial costs.

Benefits: Using Yoneos CRM for compliance can help you:

Reduce the risk of penalties and lawsuits.

Improve your company’s reputation and customer trust.

Streamline business processes and improve efficiency.

Save time and resources through automation.

Make more informed decisions based on data.

Case Studies and Testimonials from SMEs Using Yoneos CRM for Compliance:

Company Name 1: “Since implementing Yoneos CRM, we’ve seen a significant improvement in our regulatory compliance. The platform has helped us streamline our processes, ensure data security, and respond quickly to regulatory requirements.”

Company Name 2: “Yoneos CRM is a valuable tool for our SME. It has allowed us to simplify our customer data management, automate compliance tasks, and ensure the security of our operations.”

Resources and Tips for Implementing Yoneos CRM for Compliance:

Documentation and User Guides: Explore the Yoneos CRM resources and user guides to familiarize yourself with compliance features.

Support and Training: Take advantage of the support and training offered by Yoneos CRM to help you configure and use the platform effectively.

Compliance Experts: Consult with compliance experts to get advice and recommendations specific to your company and industry.

Conclusion and Future Outlook for Yoneos CRM and SME Regulatory Compliance:

Yoneos CRM is a powerful tool that can help SMEs manage regulatory compliance effectively and efficiently. By integrating Yoneos CRM’s compliance features into your business processes, you can:

Reduce Risk: Minimize the risk of regulatory breaches and costly penalties.

Enhance Trust: Gain the trust of your customers by demonstrating your commitment to data security and regulatory compliance.

Optimize Operations: Improve the efficiency of your operations and free up time to focus on growing your business.

The future of regulatory compliance is inextricably linked to emerging technologies like artificial intelligence (AI) and machine learning (ML). Yoneos CRM is constantly evolving to meet the growing needs of businesses and new regulations. By adopting Yoneos CRM, you ensure you have a reliable partner to help you navigate the ever-changing regulatory landscape and maintain your company’s compliance. 💪