Introduction: Simplifying Your Payment Management with Yoneos CRM

In today’s business world, effective payment management is crucial for success. Companies need to not only track invoices and payments but also ensure the security of financial data and optimize processes for healthy cash flow. This is where Yoneos CRM comes in.

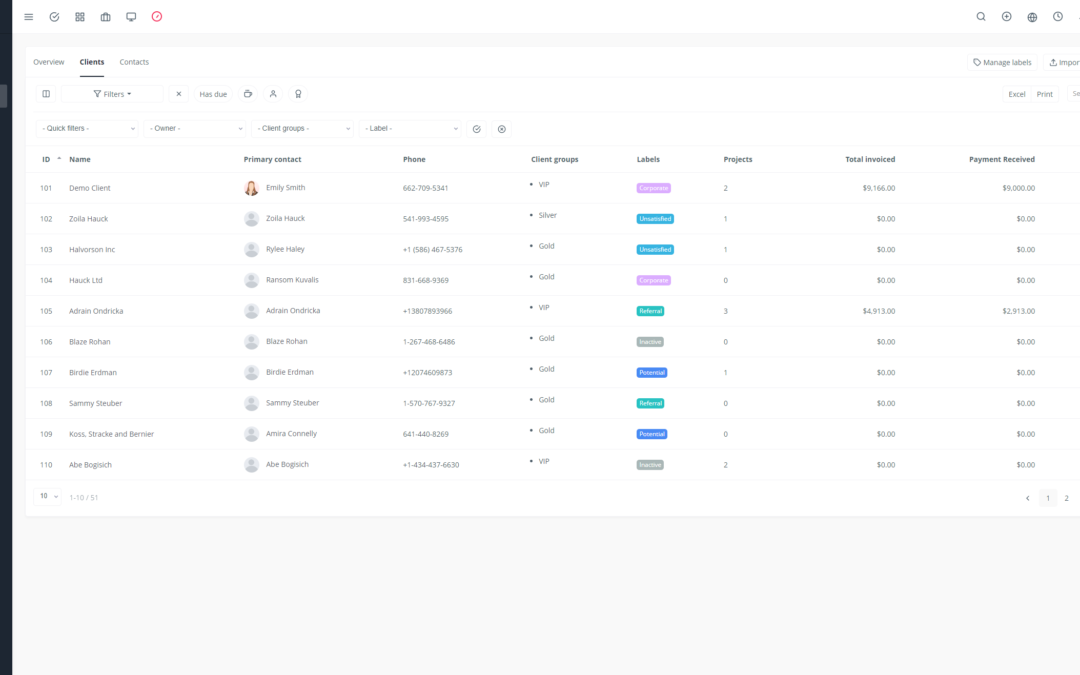

Yoneos CRM is a powerful customer relationship management (CRM) solution that integrates robust payment management features. Through its unique combination of capabilities, Yoneos CRM can help you streamline your financial operations, improve customer satisfaction, and maximize profitability.

The Challenges of Traditional Payment Management

Traditional payment management is often complex and time-consuming. Here are some common challenges businesses face:

Manual processes: Manual invoicing, payment tracking, and account reconciliation can lead to significant errors and delays.

Lack of visibility: It’s difficult to gain a comprehensive view of outstanding balances, pending payments, and cash flow.

Payment security: Protecting sensitive financial data is a top priority, but traditional methods may have security vulnerabilities.

Difficulty managing recurring payments: Tracking and managing subscriptions and recurring payments can be a headache.

How Yoneos CRM Simplifies Payment Management

Yoneos CRM offers a comprehensive solution to simplify your payment management and address the challenges outlined above. Here are the key features of Yoneos CRM that can transform your financial operations:

1. Seamless Integration with Popular Payment Gateways: Yoneos CRM seamlessly integrates with popular payment gateways like Stripe, PayPal, and Authorize.net, enabling you to accept payments directly through your CRM platform.

2. Invoice and Payment Reminder Automation: Say goodbye to tedious manual tasks! Yoneos CRM allows you to automate invoice creation and sending, as well as payment reminders.

3. Real-Time Payment Tracking and Analysis: Gain complete visibility into your financial status with real-time tracking of payments, outstanding balances, and cash flow.

4. Improved Cash Flow Visibility: Yoneos CRM provides valuable insights into your cash flow, allowing you to make informed financial decisions.

5. Reduced Invoicing and Payment Errors: Automation and centralization of payment processes minimize errors and delays related to invoicing and payments.

6. Faster Payment Cycles: With streamlined payment processes, you can receive payments faster and improve your cash flow.

7. Enhanced Customer Satisfaction: Offer your customers a seamless and user-friendly payment experience through multiple payment options and personalized payment reminders.

8. Efficient Management of Recurring Payments: Easily manage subscriptions and recurring payments, reducing the risk of errors and revenue loss.

9. Access Control and Permissions for Payment Management: Set access levels and permissions to control who has access to your sensitive payment information.

10. Detailed Payment Activity Reports: Generate detailed reports on payments, revenue, expenses, and other essential financial data.

11. Improved Dispute and Refund Management: Yoneos CRM allows you to efficiently manage disputes and refunds, reducing revenue loss and customer frustration.

12. Compliance with Payment Security Regulations: Ensure your payment operations comply with the strictest security standards.

13. Optimized Invoicing and Payment Processes: Yoneos CRM helps you streamline and automate your invoicing and payment processes, allowing you to improve efficiency and reduce costs.

14. Integration with Other Business Systems: Yoneos CRM integrates seamlessly with other business systems like accounting and inventory management software, providing better connectivity and streamlined workflow.

15. Case Studies and Customer Testimonials: Learn how other businesses have successfully transformed their payment management with Yoneos CRM.

Tips for Implementing Yoneos CRM for Payment Management

Plan your implementation: Define your objectives, key features, and impacted processes.

Train your team: Ensure your team is familiar with the new features and processes.

Test and adapt:* Start with a pilot and adjust the Yoneos CRM configuration based on your specific needs.

Conclusion: A Smoother Future for Payment Management

By leveraging Yoneos CRM for payment management, you can free your business from the constraints of traditional methods. Optimize your financial operations, improve customer satisfaction, and focus on growing your business. 🚀