In today’s digital world, customer experience is more important than ever. Businesses must find ways to enhance customer interaction at every stage of the purchase journey. And that’s where online payments come into play.

Offering a seamless and secure online payment experience is essential for building customer loyalty and boosting sales. Here’s how online payments can revolutionize your customer experience:

1. Payment Simplicity and Speed 💨

Imagine a customer who wants to buy a product on your website. They add the item to their cart, reach the checkout page… and are met with a complex and time-consuming process. They are likely to abandon their cart and shop elsewhere.

Online payments should be simple and fast.

Concise and intuitive checkout forms.

Pre-filled payment options for returning customers.

Quick processing times to avoid frustration.

2. Multiple Payment Options 💳

Every customer has their preferred payment method. Some prefer credit cards, others bank transfers, and some opt for e-wallets.

Offering a variety of payment options caters to everyone’s needs.

Credit/Debit cards

Bank transfers

E-wallets (PayPal, Apple Pay, Google Pay)

Cryptocurrencies

Financing options

3. Data Security and Privacy 🔒

Security is a top priority for online customers. They need to be sure that their personal and financial information is protected.

SSL encryption protocols to secure transactions.

Fraud detection systems to prevent malicious activity.

Clear and concise privacy policies.

4. Intuitive User Experience 💻

User experience is a key element in the success of online payments. The process must be straightforward, easy to understand, and accessible to everyone.

User-friendly and clear interfaces.

Simple and concise instructions.

Clearly displayed payment options.

Informative error messages.

5. Optimized Mobile Payments 📱

Smartphone use is constantly increasing. Businesses must ensure that their payment systems are optimized for mobile devices.

Responsive websites and mobile apps.

Mobile payment options (Apple Pay, Google Pay).

QR codes to facilitate payments.

6. Seamless Integration with Websites and Apps 🌐

Online payment solutions should integrate seamlessly with your websites and apps.

Easy-to-install and configure payment modules.

Robust APIs for customized integration.

Thorough testing to ensure compatibility.

7. Contactless Payment Options 💳

Contactless payments are gaining popularity. They allow customers to pay quickly and easily without having to enter their payment information.

NFC (Near Field Communication) technology for mobile payments.

Contactless payment terminals.

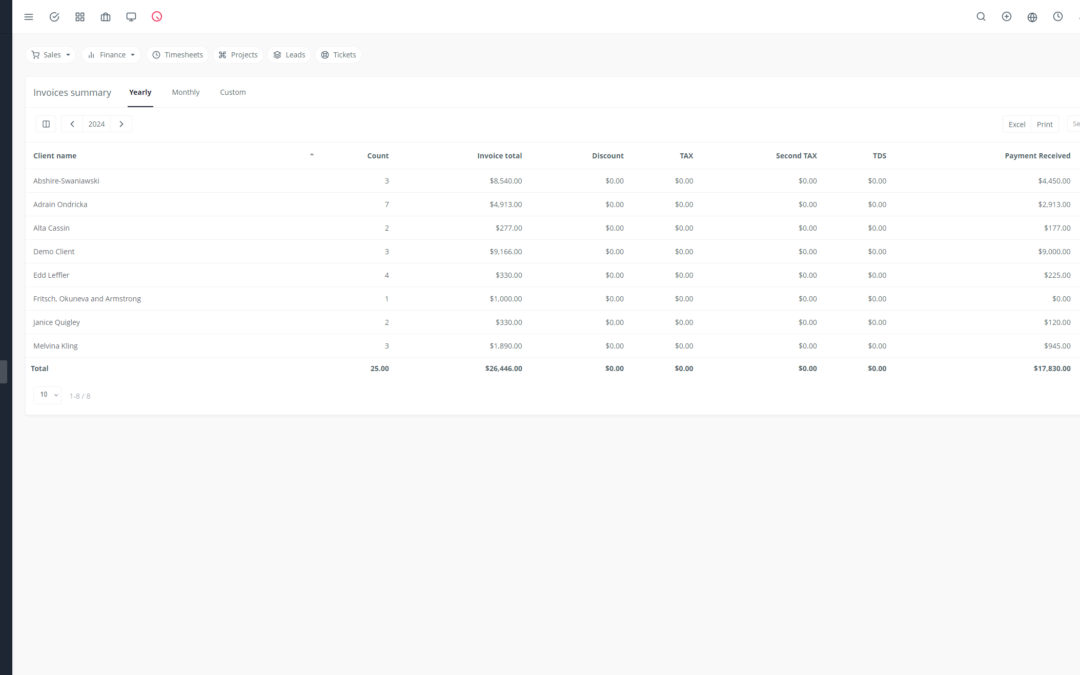

8. Easy Invoice and Transaction Management 🧾

Customers want to have an overview of their transactions.

Invoice management platforms for easy payment tracking.

Clear and detailed transaction histories.

Email or SMS alerts for payments and refunds.

9. Loyalty and Rewards Programs 🎁

Loyalty and rewards programs can incentivize customers to make repeat purchases.

Loyalty points for every purchase.

Exclusive discounts and promotions.

Referral programs.

10. Effective Customer Support ☎️

Effective customer support is essential for resolving payment issues and answering customer questions.

Multilingual customer support options.

Quick response times.

Practical and efficient solutions.

11. Payment Personalization 🎨

Personalizing the payment experience can increase customer satisfaction.

Product suggestions based on previous purchases.

Pre-filled payment options for returning customers.

Personalized promotional offers.

12. Omnichannel Experience 🛍️

Customers want to be able to pay seamlessly, regardless of the channel they are using.

Payment systems that work across websites, mobile apps, physical stores, social media, etc.

Tracking of transactions and customer preferences across all channels.

13. Reduced Payment Processing Costs 💰

Online payment solutions can reduce the costs associated with processing payments.

Lower transaction fees.

Automated processes to reduce manual work.

More efficient payment solutions.

14. Improved Customer Satisfaction 😄

A smooth and secure online payment experience helps improve customer satisfaction.

Happier and more loyal customers.

Positive feedback on your products and services.

Better brand image.

15. Increased Conversion Rates 📈

High-performing online payment systems can boost your conversion rates.

Customers more likely to complete their purchases.

Increased sales and revenue.

16. Reduced Cart Abandonment 🛒

Cart abandonment can lead to significant revenue loss. Easy and secure online payments can reduce the cart abandonment rate.

Customers less likely to abandon their carts before completing their purchase.

Additional sales and increased revenue.

17. Enhanced Brand Loyalty 💖

A positive online payment experience can enhance brand loyalty.

Customers more likely to come back for more purchases.

Improved brand image and reputation.

18. Compliance with Payment Security Regulations 🛡️

It’s crucial to comply with payment security regulations to protect your customers and your business.

Compliance with PCI DSS (Payment Card Industry Data Security Standard) standards.

Payment solutions that comply with local and international regulations.

19. International Accessibility 🌎

Online payments allow you to reach customers around the world.

Multilingual and multi-currency payment solutions.

Payment options tailored to different international markets.

20. Innovative Payment Solutions 💡

Innovation in the field of online payments is constantly evolving.

Emerging technologies like biometrics and AI to secure payments.

New payment solutions to simplify the customer experience.

Innovative payment options to meet specific customer needs.

In conclusion, online payments are an essential component of the modern customer experience. By investing in robust and innovative payment solutions, you can enhance customer satisfaction, increase sales, and build customer loyalty. 🤝