Artificial intelligence (AI) is transforming numerous industries, and payment management is no exception. Its impact is profound, ranging from process automation to enhanced customer experience and increased security. Discover how AI is reshaping the payment landscape and how your business can leverage its benefits.

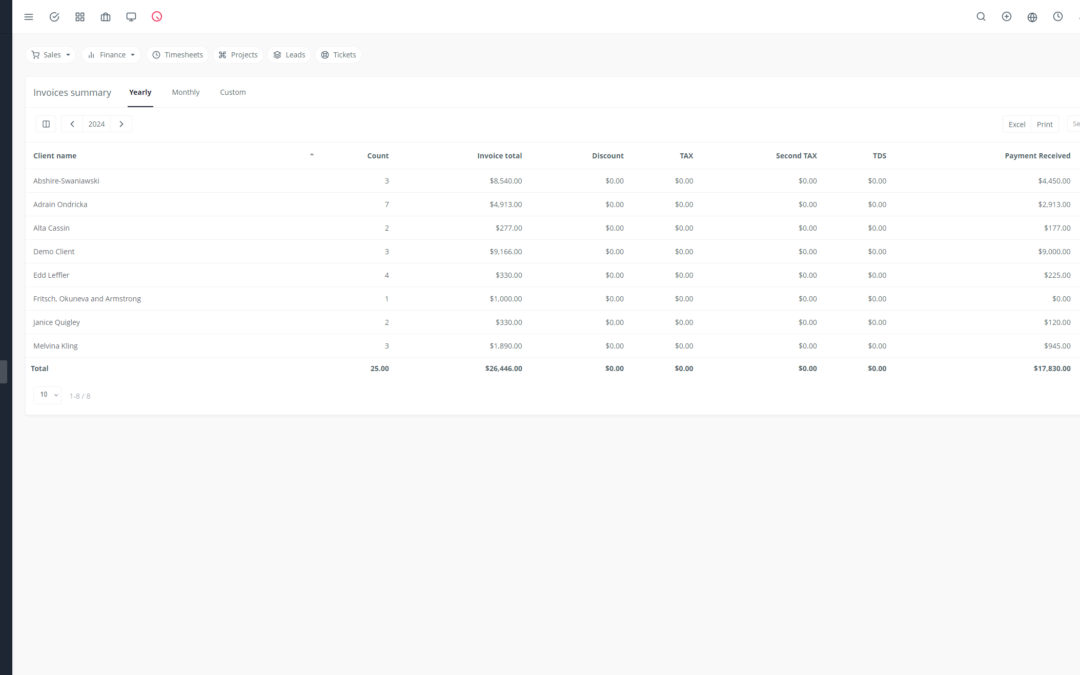

1. Payment Process Automation: 👋 Say goodbye to repetitive manual tasks! AI automates payment processes, from data validation to account reconciliation and invoice management. This frees up your teams for higher-value tasks and reduces human error.

2. Frictionless Payments: 💨 AI delivers seamless and effortless payment experiences. Through data analysis, it can predict customer needs and offer personalized payment options, simplifying the purchasing process.

3. Improved Customer Experience: 🤩 AI enables personalized customer experiences by providing offers and services tailored to their individual needs. Imagine intelligent chatbots answering customer questions 24/7 and intuitive payment platforms that streamline transactions.

4. Enhanced Fraud Detection and Security: 🔐 AI acts as a shield against financial fraud. It analyzes transactions in real time and detects suspicious activities, enabling the blocking of fraudulent attempts and safeguarding sensitive data.

5. Predictive Analytics and Insights: 📈 AI can analyze vast amounts of data to identify trends and predict future behaviors. This empowers businesses to better understand their customers, optimize their payment strategies, and anticipate future needs.

6. Payment Personalization: 🎨 AI allows for personalized payment options based on each customer’s preferences and profile. This can include flexible payment offers, tailored financing options, and customized loyalty programs.

7. Reduced Operational Costs: 💰 Process automation and reduced fraud-related errors lead to significant decreases in operational costs. AI optimizes resource utilization and improves overall efficiency in payment management.

8. Increased Efficiency: 🚀 AI speeds up and enhances payment processes. Transactions are processed faster, payment delays are reduced, and errors are minimized.

9. Enhanced Regulatory Compliance: 👮♀️ AI helps businesses comply with payment regulations by automating compliance processes and ensuring data security.

10. Simplified Cross-border Payments: 🌎 AI facilitates cross-border payments by removing language and geographical barriers. It simplifies currency conversion and streamlines international settlement processes.

11. AI Integration into Payment Platforms: 💻 Payment platforms are increasingly integrating AI to offer intelligent and personalized services. This includes features such as predictive analytics, fraud detection, and customer experience personalization.

12. Rise of Mobile and Contactless Payments: 📱 AI fuels the growth of mobile and contactless payments. With facial recognition, biometrics, and mobile payment apps, transactions become faster and more secure.

13. AI’s Influence on Fintechs: 💰 Fintechs leverage AI to develop innovative payment solutions and revolutionize the financial sector. AI powers the creation of new products and services, such as mobile payment platforms, online lending solutions, and personal finance management apps.

14. Impact on Payment Management Jobs: 💼 AI’s automation of repetitive tasks may lead to changes in the roles and skills needed in payment management. However, AI also creates new job opportunities in areas such as data science, analytics, and application development.

15. Risks and Challenges of AI Use: ⚠️ It’s essential to consider the risks and challenges associated with using AI in payment management. This includes data security, privacy, and algorithmic bias.

16. Ethics and Data Privacy: 🛡️ The use of AI in payment management raises ethical and data privacy concerns. It’s crucial to ensure the protection of personal data and adherence to privacy regulations.

17. AI’s Role in B2B Payment Management: 🤝 AI is transforming B2B payment management as well. It automates invoicing, payment, and reconciliation processes, enhances security, and reduces costs.

18. Future Trends of AI in Payments: 🚀 The future of AI in payments is promising. Key trends include the development of blockchain-based payment systems, the rise of biometric payments, and AI integration into connected devices.

19. AI Adoption Across Industries: 🌐 AI is being adopted across various sectors, from e-commerce to tourism, healthcare, and financial services. Businesses in all industries need to adapt to AI’s impact on their payment processes.

20. AI’s Impact on the Competitive Payment Landscape: ⚔️ AI is reshaping the competitive landscape of payments. Businesses that leverage AI to offer innovative and personalized services gain a competitive advantage.

AI is a disruptive force in payment management, and its impact will be felt for years to come. Companies that embrace AI and adapt to its evolution will be able to leverage its benefits and thrive in a constantly evolving market.