The financial sector is constantly evolving, with increasing demands for compliance, efficiency, and data-driven decision-making. Yoneos positions itself as a powerful solution to meet these challenges, enabling financial institutions of all types to optimize their operations and unleash their potential.

Benefits of Yoneos for Financial Institutions 🏦

Yoneos offers a robust suite of features designed specifically to meet the unique needs of the financial sector. Here are some of the key benefits:

1. Improved Operational Efficiency 📈

Automation of Manual Tasks: Streamline repetitive and time-consuming processes, such as billing, accounting, and payment management. 🤖

Enhanced Internal Communication: Create a collaborative platform for communication and information sharing between teams. 🤝

Centralized Data Management: Easily access key information and optimize decision-making. 📊

2. Financial Asset and Liability Management 💰

Accurate Asset and Liability Tracking: Gain a real-time overview of your asset and liability portfolio. 🔍

In-depth Analysis: Explore complex financial data and identify trends and opportunities. 📈

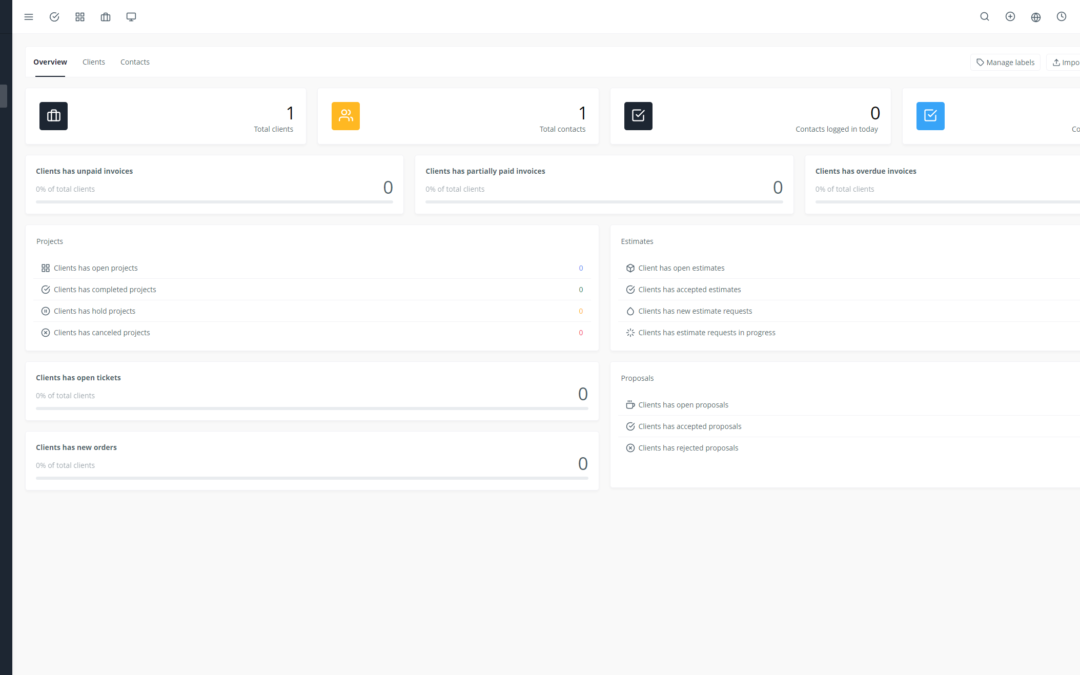

Custom Reporting and Dashboards: Create reports and dashboards tailored to your specific needs. 📊

3. Automation of Financial Tasks 🤖

Integration with Existing Financial Systems: Easily integrate Yoneos with your accounting, banking, and portfolio management systems. 🔌

Automated Workflows: Automate complex financial processes, such as investment management and regulatory compliance. ⚙️

Reduction of Manual Errors: Reduce the risk of human error and improve data accuracy. 🚫

4. Regulatory Compliance in the Financial Sector 🔒

Risk and Opportunity Management: Identify risks and opportunities related to regulatory compliance. ⚠️

Auditing and Traceability: Ensure complete traceability of financial operations and facilitate regulatory audits. 🔍

Compliance Policy Management: Implement robust and adaptable compliance policies. 🔐

5. Integration of Yoneos with Existing Financial Systems 🔌

API Connectivity: Easily integrate Yoneos with your existing financial systems, such as accounting, banking, and portfolio management software. 🔌

Data Import/Export: Easily import and export data between Yoneos and your existing systems. 📤📥

6. Risk and Opportunity Management ⚠️

Risk Analysis: Identify and assess potential financial risks, such as credit risk, market risk, and operational risk. 📊

Opportunity Management: Explore investment and business development opportunities. 📈

7. Improved Financial Decision-Making 📊

Financial Data Analysis: Explore complex financial data and identify trends and opportunities. 📈

Financial Reporting and Dashboards: Create customized reports and dashboards to track financial performance. 📊

8. Yoneos for Customer Relationship Management in the Financial Sector 🤝

Centralized Customer Data Management: Easily store and manage essential customer information. 🗃️

Automation of Customer Service Tasks: Improve customer experience by automating customer service tasks, such as billing and request management. 🤖

9. Financial Data Analysis with Yoneos 📊

Predictive Analytics: Use data analysis to predict future trends and improve decision-making. 📈

Data Visualization: Create interactive reports and dashboards to visualize financial data. 📊

10. Financial Reporting and Dashboards Based on Yoneos 📊

Custom Reports: Create customized financial reports tailored to your specific needs. 📊

Interactive Dashboards: Visualize financial data clearly and concisely using interactive dashboards. 📈

11. Yoneos for Investment Management 📈

Investment Performance Tracking: Track your investment performance in real-time. 🔍

Risk and Return Analysis: Evaluate the risks and returns of your investments. 📊

Portfolio Management: Effectively manage your investment portfolio. 💼

12. Liquidity and Treasury Management 💰

Cash Flow Management: Optimize cash flow management and forecast future needs. 💵

Loan and Borrow Management: Effectively manage loans and borrowings. 🏦

13. Using Yoneos for Financial Fraud Management 🚫

Fraud Detection: Identify potential fraudulent activities using machine learning algorithms. 🤖

Fraud Prevention: Implement fraud prevention measures to protect your business. 🔒

14. Financial Data Security with Yoneos 🔒

Data Encryption: Protect sensitive financial data using advanced encryption technologies. 🔐

Access Controls: Manage access to financial data and ensure information security. 🔒

Yoneos Success Stories in the Financial Sector 🏆

Yoneos has already helped numerous financial institutions improve their operations and achieve their business goals. Here are a few examples of success stories:

https://yoneos.com used Yoneos to automate its billing processes and improve customer satisfaction. 🚀

https://yoneos.com used Yoneos to analyze financial data and identify new investment opportunities. 📈

https://yoneos.com used Yoneos to manage risks related to regulatory compliance and reduce operational costs. 🔒

Yoneos for Lending Institutions 🏦

Yoneos can help lending institutions to:

Simplify Loan Processes: Automate loan processes and reduce processing times. 🤖

Manage Credit Risks: Assess credit risks and improve decision-making. ⚠️

Improve Customer Relationship Management: Offer an enhanced customer experience and build customer loyalty. 🤝

Yoneos for Insurance Companies 🛡️

Yoneos can help insurance companies to:

Automate Underwriting Processes: Streamline underwriting processes and reduce costs. 🤖

Manage Insurance Risks: Assess insurance risks and improve pricing. ⚠️

Improve Claims Management: Efficiently manage claims and improve customer satisfaction. 🤝

Yoneos for Investment Funds 📈

Yoneos can help investment funds to:

Manage Investments: Track investment performance, manage risks, and optimize returns. 📈

Automate Reporting: Generate customized performance reports and dashboards. 📊

Improve Compliance*: Maintain compliance with investment regulations. 🔒

The Future of Yoneos in the Financial Sector 🔮

The future of Yoneos in the financial sector is bright. With the constant evolution of technology, Yoneos will continue to innovate and offer new features to meet the changing needs of financial institutions. The integration of artificial intelligence (AI) and machine learning (ML) into Yoneos will further enhance automation, decision-making, and security.

Conclusion 🤝

Yoneos is a powerful solution that can help financial institutions overcome the challenges of the digital age. By automating processes, improving decision-making, and strengthening security, Yoneos allows financial institutions to unlock their potential and succeed in a constantly evolving market. 🚀